Not known Factual Statements About Pkf Advisory Llc

Not known Factual Statements About Pkf Advisory Llc

Blog Article

See This Report about Pkf Advisory Llc

Table of ContentsThe Best Guide To Pkf Advisory LlcNot known Facts About Pkf Advisory LlcSome Known Questions About Pkf Advisory Llc.Some Known Details About Pkf Advisory Llc Get This Report on Pkf Advisory Llc

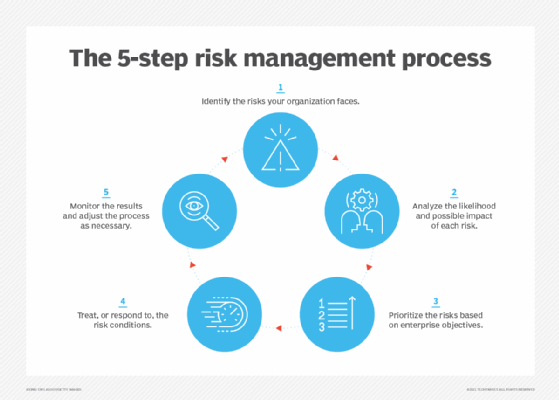

Centri Consulting Danger is an inevitable component of doing business, but it can be handled with thorough assessment and administration. As a matter of fact, most of internal and exterior threats firms encounter can be dealt with and mitigated via danger consultatory finest methods. It can be challenging to measure your risk direct exposure and make use of that information to position on your own for success.This blog is developed to aid you make the appropriate choice by answering the question "why is danger advisory vital for businesses?" We'll additionally evaluate internal controls and discover their interconnected partnership with service risk management. Basically, service risks are avoidable inner (tactical) or outside dangers that impact whether you accomplish your organizational purposes.

Every business should have a solid risk administration plan that information present danger levels and how to mitigate worst-case scenarios. Among one of the most essential risk advisory best methods is striking a balance between securing your company while also assisting in continual development. This calls for applying worldwide techniques and governance, like Board of Sponsoring Organizations of the Treadway Payment (COSO) interior controls and business threat management.

Pkf Advisory Llc Fundamentals Explained

One of the very best ways to manage threat in organization is via quantitative evaluation, which makes use of simulations or data to designate risks details numerical values. These presumed worths are fed into a risk model, which creates a variety of outcomes. The outcomes are assessed by danger supervisors, who make use of the data to determine organization possibilities and reduce unfavorable outcomes.

These records likewise include an assessment of the influence of adverse results and reduction strategies if negative occasions do happen - pre-acquisition due diligence. Qualitative risk devices consist of cause and impact diagrams, SWOT analyses, and choice matrices.

With the 3LOD design, your board of directors is liable for threat oversight, while senior administration establishes a business-wide danger culture. Responsible for having and reducing threats, operational managers look after day-to-day company dealings.

The Buzz on Pkf Advisory Llc

These jobs are typically dealt with by monetary controllership, quality assurance groups, and compliance, who might likewise have obligations within the very first line of defense. Internal auditors provide neutral assurance to the very first 2 lines of protection to make certain that threats are managed properly while still satisfying operational purposes. Third-line workers must have a direct connection with the board of directors, while still keeping a link with monitoring in economic and/or legal capacities.

A thorough collection of internal controls should include things like reconciliation, documentation, safety, permission, and separation of duties. As the number of ethics-focused capitalists continues to raise, numerous organizations are adding ecological, social, and governance (ESG) criteria to their internal controls. Financiers make use of these to determine whether a business's worths align with their very own.

Social standards check out exactly how a business handles its partnerships with workers, clients, and the bigger community. They also raise efficiency and improve conformity while simplifying operations and aiding avoid fraud.

The Definitive Guide to Pkf Advisory Llc

Constructing a thorough collection of inner controls entails approach positioning, systematizing plans and treatments, process documents, and establishing duties and obligations. Your inner controls should integrate threat advising best techniques while constantly remaining focused on your core organization goals. The most effective inner controls are tactically segregated to prevent possible disputes and reduce the risk of monetary fraud.

Developing good inner controls includes implementing rules that are both preventative and detective. They consist of: Limiting physical accessibility to equipment, supply, and cash money Splitting up of duties Permission of billings Verification of expenses These backup procedures are created to discover unfavorable end results and risks missed by the initial line of defense.

Internal audits include an extensive assessment of an organization's inner controls, including its bookkeeping methods and corporate administration. They're designed to guarantee regulative compliance, along with precise and prompt financial reporting.

The smart Trick of Pkf Advisory Llc That Nobody is Discussing

According to this legislation, administration groups are legally in charge of the precision of their business's monetary statements - pre-acquisition risk assessment. In addition to protecting financiers, SOX (and inner audit assistance) have actually reference dramatically enhanced the dependability of public accountancy disclosures. These audits are done by objective third events and are designed to review a business's accountancy treatments and internal controls

Report this page